University Venture Capital in the UK and EU

Models, Impact, and Limitations

A comprehensive analysis of university-affiliated venture capital funds driving innovation across European academic institutions

Introduction

University-affiliated venture capital (VC) funds in the UK and EU represent a critical bridge between academic research and commercial markets. These specialized investment vehicles are transforming how scientific discoveries move from laboratory to marketplace, creating new pathways for innovation-led economic growth.

This comprehensive analysis examines the diverse models of university venture capital across the UK and European Union, assessing their impact on spinout creation, deep tech commercialization, and regional ecosystem development. We explore both the remarkable successes and persistent challenges facing these funds, drawing on case studies from leading academic institutions and emerging innovation hubs.

Comparative Overview of University Venture Capital Models

Geographic Distribution and Prevalence

UK Dominance

The United Kingdom's preeminence in university venture capital is undeniable. A 2023 report identified six UK-based funds among the top 20 most active globally between 2020 and 2022 [3].

EU Landscape: A Patchwork of Innovation

The broader European Union presents a more fragmented picture. A 2025 European Commission report highlights that while the EU excels in research output, it struggles with commercialization, with only 23% of EU spin-offs operating in deep tech compared to over 60% in the US [51].

Despite this, successful models exist across Germany, Scandinavia, and France, often relying on multi-university collaborations and public-private partnerships.

Structural and Management Models

University establishes and operates its own VC fund. Example: Oxford Science Enterprises provides maximum control and alignment with university mission.

University partners with external VC firm. Example: Cambridge Innovation Capital leverages professional expertise while maintaining university connection.

Combines features of traditional VC with long-term investment vehicles. Example: University of Edinburgh's Old College Capital reinvests returns.

Case Studies of Leading University Venture Capital Funds

United Kingdom

University of Oxford

Oxford Science Enterprises

| Capital Raised | £850M+ |

| Spinout Increase | 14 → 28 annually |

| Global Ranking | Top 3 |

Established in 2015, OSE transformed Oxford's approach to technology transfer, becoming the world's largest single-university-focused fund [3].

University of Cambridge

Dual Fund Model

Cambridge Enterprise Seed Funds

In-house seed funding for early-stage validation

Cambridge Innovation Capital

Later-stage growth capital partnership

Cambridge's sophisticated dual-fund approach provides comprehensive support throughout the spinout lifecycle [3].

Northern Gritstone: Multi-University Collaboration

University of Leeds

University of Manchester

University of Sheffield

Northern Gritstone represents a strategic effort to create critical mass in northern England's innovation ecosystem, launching with £312 million capital and accelerator programs like NG Studios [24].

Germany

Technical University of Munich (TUM)

UVC Partners Collaboration

UVC Partners focuses on European B2B startups in deeptech, enterprise software, industrial tech, and mobility, with privileged access to TUM's innovation pipeline through UnternehmerTUM [119].

France and Scandinavia

🇫🇷 Sorbonne University

Managed in partnership with established private equity firms Audacia and Aloe Private Equity [197].

🇸🇪 Chalmers Ventures

Combines venture creation with tech investment under one roof, supporting global impact ventures [193].

Analysis of Impact

Financial Returns and Investment Performance

Capital Raised and Fund Sizes

University-affiliated VC funds have demonstrated remarkable capacity to attract significant capital, with Oxford Science Enterprises leading at £850M+ and multi-university funds like Northern Gritstone targeting £500M [3].

Key Success Metrics

- University of Edinburgh: Investment grew from £16.3M to £107.6M (2017/18-2022/23)

- Spinout companies increased from 55 to 123 in same period

- High-Tech Gründerfonds: €1.2B under management

Reinvestment Models

Many universities establish evergreen structures where returns from successful exits are reinvested. The University of Edinburgh explicitly commits to reinvesting returns from Old College Capital to support future spinouts.

Long-term Sustainability

This model creates a self-sustaining cycle, reducing reliance on external capital and aligning the university's financial interests with long-term spinout success.

Innovation Outcomes and Technology Transfer

Spinout Creation Acceleration

University of Oxford Impact

University of Edinburgh Growth

Deep Tech Commercialization

University VC funds are uniquely positioned to commercialize high-risk, deep tech research. The University of Bristol created one of the UK's largest quantum clusters with companies like PsiQuantum raising $450M Series D.

Case Study: Neuranics

Joint spinout from University of Glasgow and Edinburgh raised $8M seed funding for Tunnelling Magnetoresistance technology, demonstrating successful deep tech commercialization.

Technology Transfer Success

The Swedish company Oxeon exemplifies successful technology transfer, commercializing Chalmers University's composite weaving method with support from the university's entrepreneurship center.

Key Success Factors

- Robust IP protection and patent strategy

- Business support from university centers

- Access to early-stage funding

- Integration of academic and commercial expertise

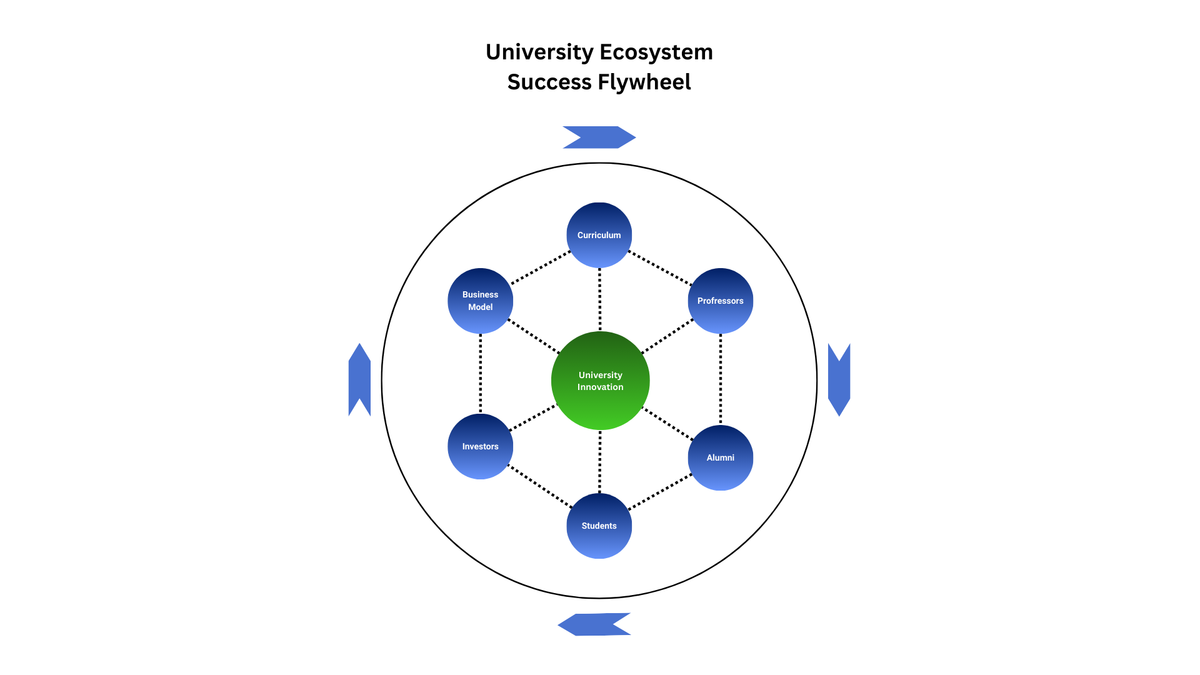

Ecosystem Development

University funds catalyze innovation clusters like Bristol's quantum hub and Finland's Espoo Innovation Garden around Aalto University.

Building networks of mentors and advisors is crucial. SETsquared provides access to over 1,000 mentors, while Edinburgh's Innovation Fellowship scheme develops future founders.

Entrepreneurship is increasingly integrated into curricula, with universities like Edinburgh recognizing innovation in promotion criteria.

Analysis of Limitations and Challenges

Structural and Operational Hurdles

Bureaucracy & IP Negotiations

Complex, Fragmented Processes

Key Issues

- Understaffed technology transfer offices

- Lengthy invention disclosure processing

- Complex IP negotiations with multiple stakeholders

- Contentious university equity stake discussions

A 2023 European Commission report highlighted complex and fragmented IP regulations as key barriers to spinout growth [51].

Timeline Misalignment

Academic vs. Investment Horizons

This mismatch creates tension, particularly for deep tech and life sciences ventures where development paths can span decades.

The "Valley of Death" Challenge

The "Valley of Death"

Persistent Funding Gap Challenge

The critical funding gap between initial proof-of-concept and later-stage investment remains a significant challenge across the UK and EU. Even successful programs like Switzerland's Venture Kick report that around 50% of promising applicants cannot be supported due to lack of available capital.

Current Limitations

- Limited university fund resources

- High risk profile for traditional investors

- Institutional/legal constraints

- Lack of continuous funding commitment

Impact on Spinouts

- Promising technologies stranded

- Talent drain to better-funded regions

- Delayed commercialization timelines

- Reduced competitive positioning

Unfavorable Equity Structures

High university equity stakes can deter private investment. The 2023 UK Independent Review highlighted this as a key issue, recommending more flexible and transparent equity models.

Recommended Solutions

- Smaller initial equity with option to invest later

- Sliding scale based on university support level

- Transparent, standardized deal terms

- Founder-friendly negotiation processes

Inconsistent EU Capital Access

Capital access varies dramatically across EU member states. A 2025 European Commission report noted fragmented support systems and inconsistent funding as major barriers to spinout growth.

Regional Disparities

- UK "Golden Triangle" vs. other regions

- Munich area vs. other German regions

- Brain drain to established hubs

- Uneven playing field for startups

Policy Considerations and Future Directions

Recommendations from the UK Independent Review

UK Government Action Plan

2023 Independent Review Recommendations

Standardize Deal Terms

Develop standardized, transparent, and founder-friendly deal terms to streamline the spinout process and reduce transaction costs.

- Consistent equity models

- Transparent expectations

- Streamlined negotiations

Improve Transparency

Require universities to collect and publish standard data on spinout activities for evidence-based policymaking.

- Number of spinouts created

- Investment amounts raised

- Jobs created metrics

Align Incentives

Adopt collaborative approaches where focus is on creating long-term value for all stakeholders.

- Equitable exit proceeds

- Flexible IP licensing

- Tailored support programs

EU-Level Initiatives and Strategies

Addressing EU Fragmentation

Single Market for Venture Capital

Create integrated market to eliminate cross-border barriers and provide seamless access to funding across member states.

European Innovation Council

One-stop shop providing early-stage grants to later-stage equity investments with comprehensive support network.

Cross-Border Collaboration

Promote multi-university funds and cross-border partnerships to pool resources and expertise across the EU.

European Venture Capital Fund-of-Funds

Pool resources from across EU to create more robust investment vehicles

Network of Universities of Applied Sciences

Foster entrepreneurship culture and collaborative innovation projects

Deep Tech Commercialization

Enhance support for translating world-class EU research into commercially viable deep tech solutions.

Deep Tech Initiative

Comprehensive support from early grants to equity investments

European Technology Transfer Office

One-stop shop for TTOs with training and expert network access

Future Outlook

Expected Impact and Success Factors

Key Success Factors

- ✓ Standardized, transparent deal terms across universities

- ✓ Harmonized EU regulations and support systems

- ✓ Increased growth capital availability for scaling

- ✓ Enhanced deep tech commercialization support

Expected Impact

- ↗ Increased spinout creation rates across Europe

- ↗ Better access to follow-on funding for growth

- ↗ Reduced brain drain to other regions

- ↗ Enhanced European innovation competitiveness

Conclusion

The landscape of university venture capital in the UK and EU reveals both remarkable successes and persistent challenges. The UK's mature ecosystem, anchored by powerhouses like Oxford Science Enterprises and Cambridge's dual-fund model, demonstrates the transformative potential of well-structured university VC funds. Meanwhile, innovative multi-university collaborations across the EU, from Northern Gritstone to Denmark's climate-focused initiatives, showcase alternative approaches to pooling resources and expertise.

The evidence is clear: university VC funds significantly accelerate spinout creation, with Oxford doubling its annual spinouts within five years of launching OSE, and Edinburgh growing from 55 to 123 companies while increasing investment seven-fold. These funds are particularly crucial for deep tech commercialization, bridging the notorious "valley of death" between proof-of-concept and market-ready products.

Key Takeaways for Stakeholders

For Universities

- Invest in professional technology transfer capabilities

- Develop transparent, founder-friendly deal terms

- Consider multi-university collaborations for scale

- Integrate entrepreneurship into academic culture

For Policymakers

- Harmonize IP regulations across EU member states

- Create tax incentives for university spin-off investments

- Support growth capital initiatives for scaling

- Facilitate cross-border collaboration frameworks

For Investors

- Recognize the unique value proposition of university spinouts

- Develop specialized deep tech investment capabilities

- Partner with universities for deal flow and due diligence

- Support long-term development timelines

Looking ahead, the success of European university venture capital will depend on addressing structural challenges while building on existing strengths. The fragmented EU landscape requires coordinated policy responses, while the UK must maintain its competitive edge through continued innovation in fund structures and support mechanisms.

The stakes could not be higher. In an era of global competition for technological supremacy, university VC funds represent a critical lever for translating Europe's world-class research capabilities into commercial success. The foundations are strong, the models are proven, and the potential for impact is immense. The question is not whether university venture capital will play a crucial role in Europe's innovation future, but how quickly and effectively stakeholders can address the remaining barriers to unlock its full potential.

Report Summary: Key Findings

Major Successes

- UK leads with mature, well-capitalized ecosystem

- Multi-university funds creating critical mass

- Significant impact on spinout creation rates

- Deep tech commercialization successes

Key Challenges

- Persistent "valley of death" funding gap

- Complex IP negotiations and bureaucracy

- Inconsistent capital access across EU

- Growth capital scarcity for scaling

Future Priorities

- Standardized, transparent deal terms

- Harmonized EU regulations

- Enhanced cross-border collaboration

- Increased growth capital availability

Analysis based on comprehensive research of university venture capital funds across the UK and European Union, 2020-2025