Amplifying ecosystem voices to push boundaries and build innovation communities that foster entrepreneurship and drive economic growth

© 2026 The Innovation Ecosystem Lab. Published with Ghost

How a UK Startup Discovered £90K in R&D Tax Relief for Digital Token Payments in 2021

Back in 2021, Consilience Ventures pioneered a tokenised execution capital system, discovering their £90k R&D tax credit qualified despite using digital tokens. This breakthrough eliminated barriers for startups accessing execution finance through their innovative portfolio-backed token model.

Evergreen, VCT or Closed-ended Fund Structures: What's Best for Studios, Incubators, and Accelerators?

Startup programmes need people, process, and runway—not just capital. This analysis compares how closed-end funds, VCTs, and evergreen structures align with modern ecosystem builders' missions, examining everything from launch timelines to investor inclusion and operational agility.

How startup programs can leverage sweat equity to unlock their next growth phase

Startup programmes hit growth ceilings offering advice, not execution. Sweat equity seemed like the answer but it's messy and unsustainable. Execution Capital changes this: founders get a Grow-Now, Pay-Later Budget to hire experts with capped, milestone-driven repayments.

The accelerator economy: a comprehensive analysis of sustainability and viability

Global accelerator market hits $5.3B but 90% of programs fail within 18 months due to cash flow issues. Elite accelerators like Y Combinator achieve 93% startup survival rates while most struggle. Winner-take-all ecosystem where only top-tier programs generate sustainable returns.

University Venture Capital in the UK and EU: models, impact, and limitations

UK leads with Oxford’s £850M fund; EU hubs like TUM (UVC) & KU Leuven (Gemma) scale spinouts. Impact: faster spinouts, deep-tech wins. Limits: IP red tape, equity fights, capital gaps.

From Labor Notes to Silicon Valley: The 200-Year Evolution of Sweat Equity

Sweat equity isn't a modern startup invention—it's a 200-year-old mechanism for converting labour into ownership. From Benjamin Franklin's print shop partnerships to today's tech unicorns, the core principle remains unchanged: effort, when structured correctly, builds value and belonging.

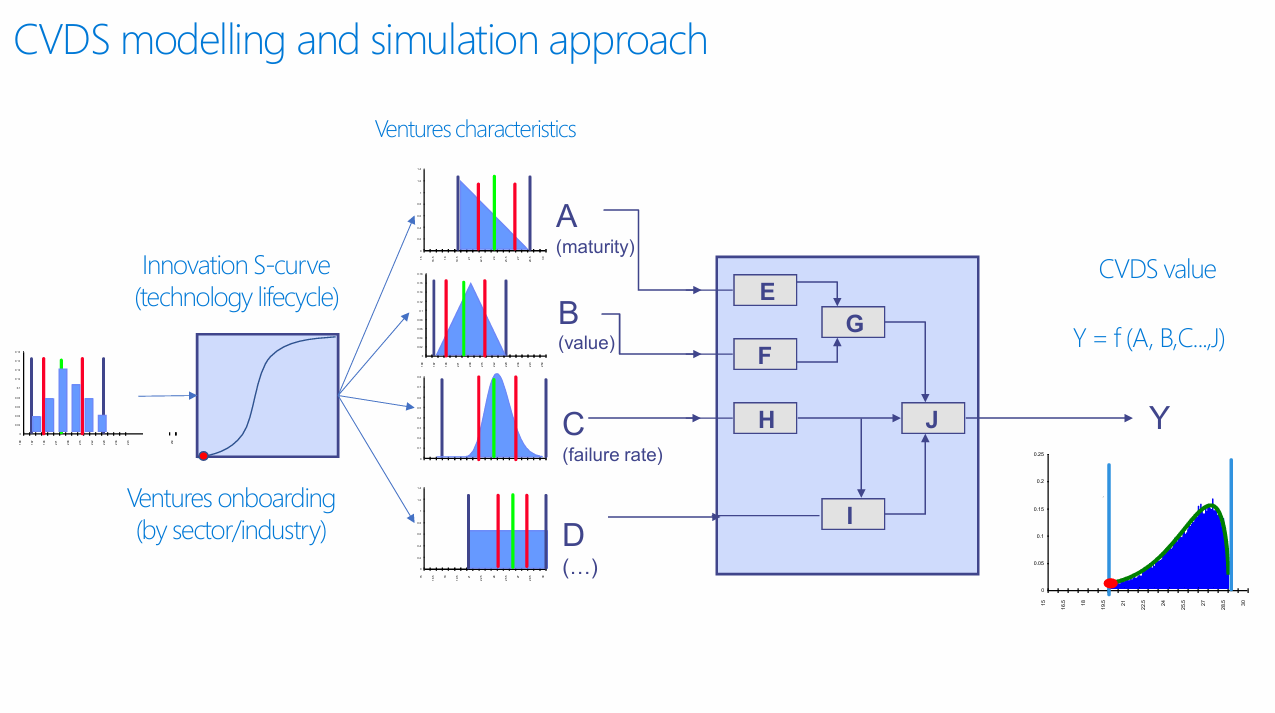

Scientific Analysis: Conceptualizing Value in the Consilience Ventures Digital Share (CVDS) Startup Ecosystem

CVDS redefines startup valuation through multi-dimensional modeling: Value = f(startup health). Integrates maturity assessment, sprint fundraising, continuous tracking, and S-curve analysis. Advances beyond financial metrics to systematic ecosystem management with real-time adaptation capabilities.

Consilience Ventures Impact Case Study

Deep dive into the Consilience Ventures Impact Report.

Ultimate Startup Ecosystem Glossary: Key Terms for Founders, Investors, Experts, Policy Makers, and Ecosystem Developers

Essential startup terminology guide covering accelerators, funding rounds, MVP, product-market fit & more. Decode the entrepreneurship landscape with definitions tailored for founders, investors, and ecosystem developers navigating today's innovation economy.

Stay in the loop.

Sign up to receive updates and the latest news from Split.

Your email