The accelerator economy: a comprehensive analysis of sustainability and viability

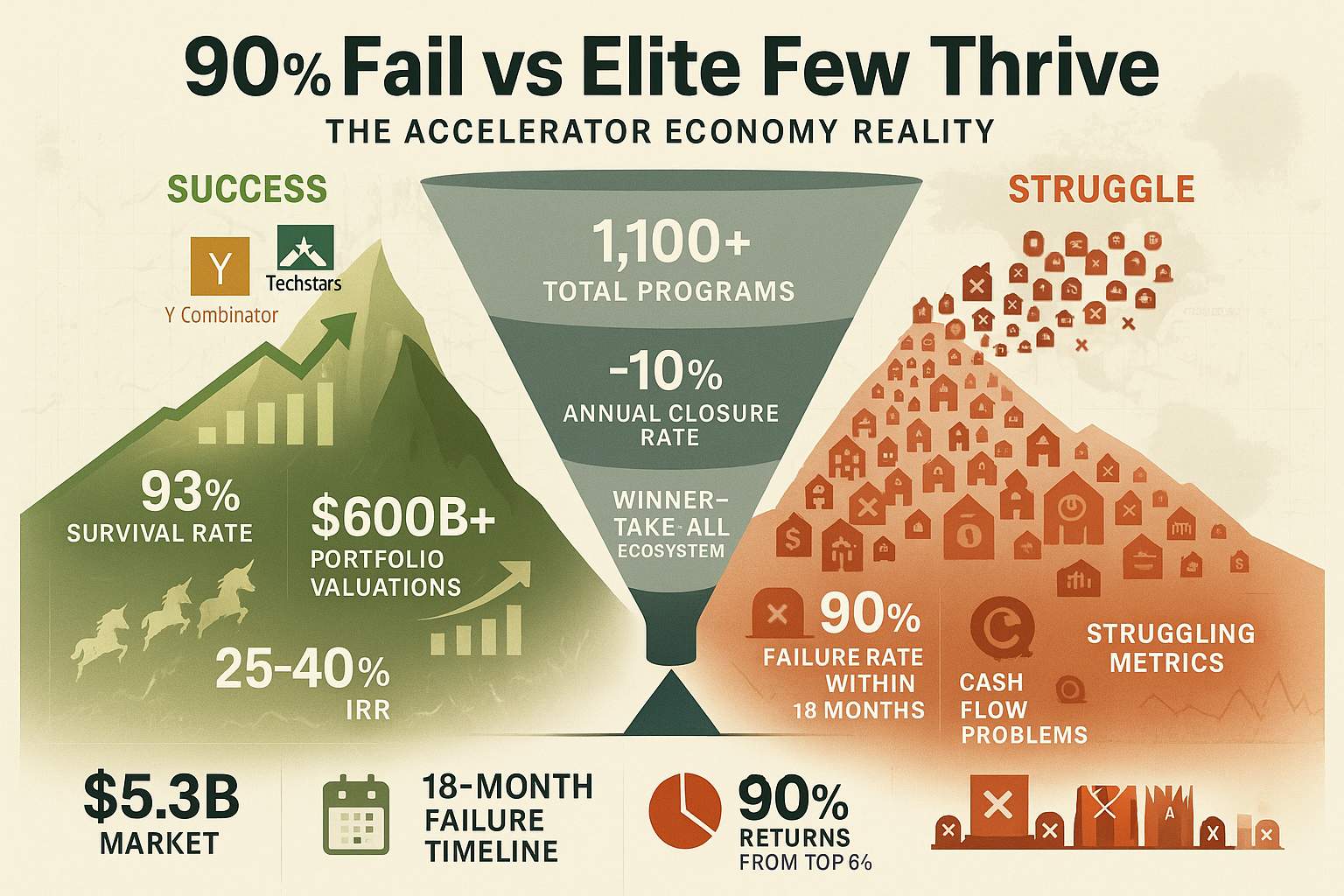

The startup incubator and accelerator industry reveals a stark bifurcation between elite programs achieving exceptional returns and a broader population struggling with fundamental sustainability challenges. While the global market has grown to $5.3 billion with projections reaching $11 billion by 2034, research shows that 90% of accelerators fail within 18 months due to cash flow issues, creating a winner-take-all ecosystem where only top-tier programs consistently generate sustainable returns.

This analysis examines survival rates, financial structures, and business model viability across 1,100+ tracked programs globally, revealing critical insights about which models work, why most fail, and what the future holds for this rapidly evolving industry.

Survival rates paint a troubling picture for most programs

The accelerator industry exhibits extreme mortality rates that dwarf typical business failure statistics. Approximately 10% of accelerators cease operations annually, with most programs failing within their first 18 months due to unsustainable cash flow models. This represents roughly 75-120 programs stopping applications each year from the global pool of active accelerators.

Corporate-sponsored accelerators perform particularly poorly, showing only an 8% success rate compared to 12% for independent accelerators. Research from CB Insights and industry analysis reveals that corporate programs suffer from identity crises where startups maintain parent company identities rather than developing entrepreneurial mindsets, misaligned incentives between corporate objectives and startup needs, and insufficient autonomy for disruptive innovation.

However, the programs that survive demonstrate remarkable impact on startup outcomes. Accelerated startups show 23% higher survival rates than non-accelerated companies, with UK data showing 92% survival rates for accelerator-backed startups versus 75.6% for general small businesses. Top-tier programs like Y Combinator achieve 93% startup survival rates compared to 80% for Techstars and 81% for 500 Startups.

The key determinants of accelerator success center on program specialization, rigorous selection processes, quality mentor networks, and sustainable revenue diversification. Successful programs focus on specific industry verticals rather than broad approaches, maintain highly selective screening with clear success metrics, and build dedicated networks of operationally experienced mentors rather than celebrity advisors.

Global industry reaches massive scale but shows concerning concentration

The accelerator ecosystem has experienced explosive growth over the past decade, expanding from fewer than 500 tracked programs in 2013 to over 1,100 programs by 2020 - representing more than doubling in size. The global startup accelerator market reached $5.02-5.3 billion in 2024, while the broader business incubator market hit $25.93 billion, with combined projections reaching $55+ billion by 2034.

Regional distribution reveals stark geographic concentration that limits accessibility and creates sustainability challenges for programs outside major hubs. North America dominates with 41% of global market share, led by a $1.9 billion US market, while Europe maintains significant representation and Asia-Pacific captures 27.7% of the business incubator market as the fastest-growing region.

The industry shows clear signs of market saturation in traditional hubs, with Silicon Valley, Boston-Cambridge, and New York hosting 40% of all US accelerators despite representing a tiny fraction of geographic area. This concentration creates fierce competition for deal flow and makes it difficult for new programs to differentiate, while emerging markets in Latin America, Africa, and Southeast Asia show lower density but higher growth potential.

Annual deal activity demonstrates the scale of accelerator influence: the top 50 most active accelerators collectively backed 7,794 deals in 2022, representing a 14% year-over-year increase despite broader market declines. These programs help startups raise over $15 billion collectively, with median annual deal counts reaching 83 for top accelerators.

Financial models reveal extreme dependency on rare outlier successes

Accelerator economics operate on venture-style return models with extreme power law distributions that create sustainability challenges for most programs. The primary revenue model centers on equity stakes ranging from 5-10% in exchange for investments of $20,000-$500,000, with Y Combinator's current model providing $500,000 total funding ($125,000 for 7% equity plus $375,000 uncapped SAFE) and Techstars offering $220,000 for 5% equity.

Top-tier accelerators demonstrate exceptional returns when successful. Y Combinator's portfolio shows remarkable performance with $1 billion invested across 5,000+ companies generating over $600 billion in combined valuation, producing 125 companies valued at $150+ million and 25 worth over $1 billion. However, this success masks the underlying mathematics: 90% of returns come from the top 6% of companies that achieve unicorn status, with Y Combinator's top two companies (Airbnb and Stripe) representing over 50% of decacorn value.

The unit economics reveal challenging realities for most programs. Operating costs include mentor compensation, office space, events, staff salaries, and the seed capital provided to portfolio companies, while revenues remain heavily dependent on eventual exits that may take 7-10 years to materialize. Only 2% of companies from even the top 20 accelerators achieve successful exits, creating a bleeding-money scenario for programs that cannot access or select the rare outliers.

Secondary revenue streams provide stability but limited upside: 72% of accelerators report corporate partnerships as their primary growth engine, while program fees, consulting services, and follow-on investment opportunities supplement equity returns. However, these streams rarely generate sufficient revenue to sustain operations without successful portfolio exits.

Business sustainability requires exceptional execution and market positioning

The accelerator business model can be highly profitable but demands exceptional execution across deal flow, selection, and portfolio management. Successful programs like Y Combinator and Techstars achieve 25-40%+ IRRs for limited partners, while failed accelerators often lose money or barely break even due to their inability to identify and support the rare high-growth companies that drive returns.

Profitability analysis reveals clear stratification: top-tier accelerators with strong deal flow, high success rates, and substantial follow-on opportunities maintain sustainable operations, while mid-tier and newer accelerators face significant viability challenges. The key differentiators include access to the best startups, quality of mentor networks, and ability to attract follow-on investment for portfolio companies.

Alternative revenue models are emerging as programs seek sustainability beyond pure equity plays. Venture studios represent a rising model where programs co-create companies from the ground up rather than just providing support, taking higher equity stakes (10-20%) but offering more hands-on involvement. Revenue-based financing integration through models like TinySeed provides non-dilutive funding options that reduce equity requirements while focusing on sustainable growth rather than venture-scale exits.

Corporate partnerships offer stability with strategic limitations. While corporates report 10x returns on innovation spending (investing 2% of revenue in innovation to generate 20% of sales from new products), corporate-sponsored accelerators struggle with misaligned incentives, insufficient autonomy, and corporate "innovation antibodies" that reject disruptive ideas.

Long-term viability depends on specialization and sustainable differentiation

Expert analysis and academic research strongly support the long-term viability of the accelerator model for top-tier programs while questioning sustainability for the broader population. Harvard Business Review's 2024 analysis notes that while startups achieve higher funding and survival rates, "the sustainability of the accelerator model itself remains questionable due to dependence on outlier successes."

Successful programs demonstrate clear patterns: Y Combinator's focus on technical founders and compressed advice delivery, Techstars' mentor-driven model with geographic diversification, and specialized programs like climate tech accelerators that leverage sector expertise. These programs succeed through rigorous selection (Y Combinator accepts less than 3% of applicants), quality mentor networks, and strong investor relationships for follow-on funding.

Market evolution favors specialization over generalization. Sector-specific accelerators focusing on AI, climate tech, fintech, and healthcare show stronger performance than broad-based programs, with specialized knowledge and networks providing clearer value propositions. The data suggests that strategic consolidation and quality improvement would better serve entrepreneurs than continued expansion of marginally effective programs.

Future sustainability requires adapting to changing market conditions: increased competition demanding differentiation, rising operational costs, need for more sophisticated selection criteria, and pressure for measurable impact demonstration. Programs that cannot demonstrate clear value beyond capital provision face increasing challenges in attracting top startups and achieving sustainable returns.

Conclusion: A maturing industry with clear winners and losers

The startup accelerator and incubator industry has evolved from a nascent support mechanism into a mature, multi-billion dollar ecosystem critical to global innovation. However, success is highly concentrated among a small number of elite programs that have achieved sustainable operations through exceptional execution, while the majority of programs struggle with fundamental business model challenges.

The evidence suggests that quality trumps quantity in this ecosystem. Rather than creating more programs, stakeholders should focus on supporting proven models, improving program design, and building sustainable infrastructure. The industry's future lies in specialization, strategic partnerships, and innovative revenue models that reduce dependence on rare outlier successes while maintaining the intensive support that makes top accelerators valuable to entrepreneurs.

For entrepreneurs considering accelerator programs, due diligence on program track records, mentor quality, and post-program support structures remains essential. For policymakers and investors, the data supports concentrating resources on established, effective programs rather than proliferating additional marginally viable initiatives that struggle to achieve their stated objectives.

References and Citations

Market Research and Industry Reports

- Business Research Insights. "Startup Accelerator Market Size, Share & Report [2025-2033]." https://www.businessresearchinsights.com/market-reports/startup-accelerator-market-115518

- Coherent Market Insights. "Business Incubator Market Size, Trends & Forecast, 2025-2032." https://www.coherentmarketinsights.com/industry-reports/business-incubator-market

- Market.us. "Startup Accelerator Market Size, Share | CAGR of 8.20%." https://market.us/report/startup-accelerator-market/

- The Brainy Insights. "Business Incubator Market Trends, Statistics & Outlook." https://www.thebrainyinsights.com/report/business-incubator-market-14440

Academic Research and Analysis

- Harvard Business Review. "What Sets Successful Startup Accelerators Apart." March 2024. https://hbr.org/2024/03/what-sets-successful-startup-accelerators-apart

- Knowledge at Wharton. "Do Accelerators Improve Startup Success Rates?" https://knowledge.wharton.upenn.edu/article/do-accelerators-improve-startup-success-rates/

- ResearchGate. "The Selection Process and Criteria of Impact Accelerators. An Exploratory Study." https://www.researchgate.net/publication/352323486_The_Selection_Process_and_Criteria_of_Impact_Accelerators_An_Exploratory_Study

- ResearchGate. "UBI Global World Rankings of Business Incubators and Accelerators 2019-2020." https://www.researchgate.net/publication/338992258_UBI_Global_World_Rankings_of_Business_Incubators_and_Accelerators_2019-2020

Industry Analysis and Data

- Brookings Institution. "Accelerating growth: Startup accelerator programs in the United States." https://www.brookings.edu/articles/accelerating-growth-startup-accelerator-programs-in-the-united-states/

- CB Insights. "The most active startup accelerators and where they're investing." https://www.cbinsights.com/research/report/most-active-startup-accelerators/

- CB Insights. "The Disruption of Management Consulting." https://www.cbinsights.com/research/disrupting-management-consulting/

- UBI Global. "World Rankings of Business Incubators and Accelerators." https://www.ubi-global.com/incubator-accelerator-rankings

Accelerator-Specific Sources

- Y Combinator. "The Y Combinator Standard Deal." https://www.ycombinator.com/deal

- Y Combinator. "Resources for Investors." https://www.ycombinator.com/investors

- Techstars. "Techstars Investment Terms Update." https://www.techstars.com/newsroom/investment-terms

- Wikipedia. "Y Combinator." https://en.wikipedia.org/wiki/Y_Combinator

- Wikipedia. "Techstars." https://en.wikipedia.org/wiki/Techstars

Expert Commentary and Analysis

- Medium (ByteBridge). "Y Combinator: A Comprehensive Analysis of the World's Leading Startup Accelerator." https://bytebridge.medium.com/y-combinator-a-comprehensive-analysis-of-the-worlds-leading-startup-accelerator-5c927b8af7ae

- Medium (David E. Weekly). "Why Corporate Incubators Fail. And an idea on what to do about it." https://dweekly.medium.com/why-corporate-incubators-fail-9e9352152fcf

- LinkedIn. "Here is why most startup accelerators fail." https://www.linkedin.com/pulse/here-why-most-startup-accelerators-fail-andy-cars

- LinkedIn. "Financial sustainability of Business Incubators & Accelerators." https://www.linkedin.com/pulse/financial-sustainability-business-incubators-islam-mohamed

Financial and ROI Analysis

- GoingVC. "Catalysts of Startup Success: How Accelerators Drive Entrepreneurial Finance." https://www.goingvc.com/post/catalysts-of-startup-success-how-accelerators-drive-entrepreneurial-finance

- LinkedIn. "What is the average ROI of an accelerator investing in startups?" https://www.linkedin.com/pulse/what-average-roi-accelerator-investing-startups-hugh-mason

- Market Sentiment. "The YC Report." https://www.marketsentiment.co/p/the-yc-report

- The Wealth Mosaic. "How to measure the ROI of a startup accelerator." https://www.thewealthmosaic.com/vendors/tenity/blogs/how-to-measure-the-roi-of-a-startup-accelerator/

Educational and Reference Sources

- Harvard Business School Online. "Startup Incubator vs. Accelerator: Which Is Right for You?" https://online.hbs.edu/blog/post/startup-incubator-vs-accelerator

- Stripe. "Startup accelerator vs. incubator | The differences businesses need to know." https://stripe.com/resources/more/startup-accelerator-vs-incubator-the-differences-businesses-need-to-know

- Wikipedia. "Startup accelerator." https://en.wikipedia.org/wiki/Startup_accelerator

Regional and Directory Sources

- GrowthMentor. "The 53 Best Startup Accelerators in the World (Sorted by Country)." https://www.growthmentor.com/blog/best-startup-accelerators/

- Salesflare. "The top 40 startup accelerators and incubators in North America in 2022." https://blog.salesflare.com/top-startup-accelerators-incubators-us-canada

- Startup Savant. "Best Startup Accelerators 2025." https://startupsavant.com/best-startup-accelerators

Additional Analysis

- Fast Company. "Do Accelerators And Incubators Serve Themselves Better Than Startups?" https://www.fastcompany.com/3055445/do-accelerators-and-incubators-serve-themselves-better-than-startups

- The Drum. "Startup incubators were supposed to be the future of retail – so what went wrong?" https://www.thedrum.com/news/2021/08/16/startup-incubators-were-supposed-be-the-future-retail-so-what-went-wrong

- BCG. "Incubators, Accelerators, Venturing, and More." https://www.bcg.com/publications/2014/mergers-acquisitions-growth-incubators-accelerators-venturing-more