The Brutal Truth About Launching VC Funds from Venture Studios

You've been sold a lie.

The venture capital industry wants you to believe that if you're serious about scaling your studio, you must launch a traditional VC fund. They want you to spend 18 months in regulatory purgatory, burn through hundreds of thousands in setup costs, and lock yourself into rigid structures that benefit LPs more than your startups.

Meanwhile, your competitors are already deploying capital, scaling their portfolios, and generating revenue—all while you're still filling out compliance paperwork.

The Dual-Entity VC model isn't just expensive—it's a strategic disaster for modern venture studios.

Here's what the industry won't tell you: While you're wasting 12-18 months setting up a fund that might never raise enough capital, agile studios using the CX Protocol are already 3-4 investment cycles ahead of you, with zero regulatory delays and immediate revenue generation.

The Hidden Costs That Will Crush Your Studio

Let's talk numbers that VC advisors conveniently forget to mention:

The Real Financial Damage:

- Setup costs: £250k-£300k before your first investment

- Time to first deal: 12-18 months (if everything goes perfectly)

- Ongoing compliance: £50k-£100k annually

- Fund management salaries: £150k-£300k per year for qualified personnel

- Audit and legal fees: £25k-£75k annually

- Opportunity cost: Every month you're not investing is revenue lost forever

The Hidden Structural Problems:

- LP dependency: Your investment pace is dictated by outside investors, not market opportunities

- One-size-fits-all deals: Every startup gets the same boring equity-for-cash structure

- Expert exclusion: Your best advisors get nothing beyond token fees

- Limited firepower: Once the fund is deployed, you're done until the next fundraise

- Exit pressure: LPs demand liquidity events, forcing premature exits that hurt long-term value

Bottom line: You could be 2+ years and £500k+ into this journey with nothing to show for it except regulatory approval and a half-raised fund.

The CX Protocol: Built for Venture Studios Who Want Results, Not Red Tape

While traditional funds are drowning in bureaucracy, the CX Protocol gives you everything you need to start investing immediately—with better terms, lower costs, and infinitely more flexibility.

What You Get From Day One:

🚀 Immediate Deployment Capability

- Launch in 4-8 weeks, not 18+ months

- Start making investments while competitors are still in regulatory review

- No fund size limitations—scale based on opportunities, not artificial caps

💰 Multiple Revenue Streams

- Transaction fees on every deal

- Platform licensing revenue from expert network

- Equity positions in portfolio companies

- Revenue share from successful exits

- Start earning from day one, not after 3-5 year fund cycles

🛠 Complete Infrastructure Stack

- Whitelabel SaaS platform with your branding

- Smart contracts for hybrid equity + revenue deals

- Expert marketplace and matching algorithms

- Real-time portfolio tracking and analytics

- Built-in governance and dispute resolution

⚡ Revolutionary Deal Structures

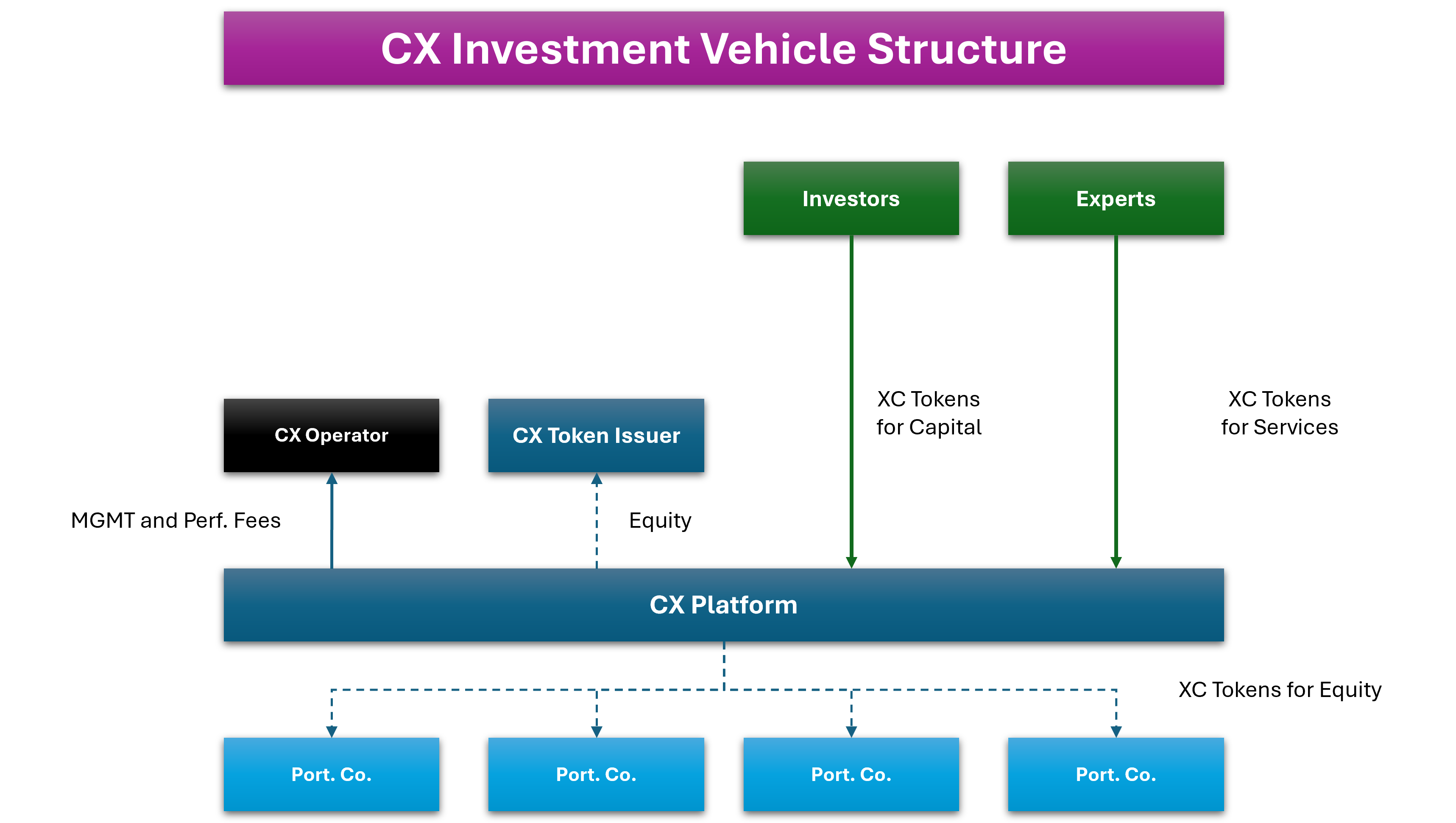

- Execution Capital (XC): Deploy expert time as tokenized credits

- Hybrid equity + revenue sharing: Align with startup cash flows, not just exits

- Expert incentive alignment: Your advisors earn from both immediate work AND long-term success

- Flexible terms: Every deal can be customized to maximize value

🌐 Global Scalability

- Operate across jurisdictions without separate fund licenses

- Cross-border expert and startup matching

- Interoperable with other CX Protocol studios

- Network effects that compound your competitive advantage

- Launch multiple tokens for different asset class (stage, location, milestones etc...)

The Numbers Don't Lie: CX Protocol vs. Traditional VC Fund

| Critical Factor | Traditional VC Fund | CX Protocol | Your Advantage |

|---|---|---|---|

| Time to Launch | 12-18 months | 4-8 weeks | Start investing 40x faster |

| Setup Investment | £250k-£500k | £15k-£50k | Save £400k+ upfront |

| Regulatory Risk | High (license rejection possible) | Zero (compliance built-in) | Guaranteed launch |

| Annual Overhead | £200k-£400k | £20k-£60k | 90% cost reduction |

| Deal Flexibility | Rigid equity structures | Infinite customization | Match every opportunity |

| Expert Economics | Token advisory fees | Meaningful upside participation | 10x better talent retention |

| Revenue Timeline | Year 3-5 (maybe) | Week 1 | Immediate cash generation |

| Scaling Speed | Limited by fund size | Unlimited | Grow with market demand |

| Geographic Reach | Single jurisdiction | Global from day one | Worldwide opportunities |

| Technology Stack | DIY/patchwork | Enterprise-grade included | Best-in-class tools included |

Why Top Venture Studios Are Making the Switch

"We Are Wasting Time While Competitors Are Winning Deals"

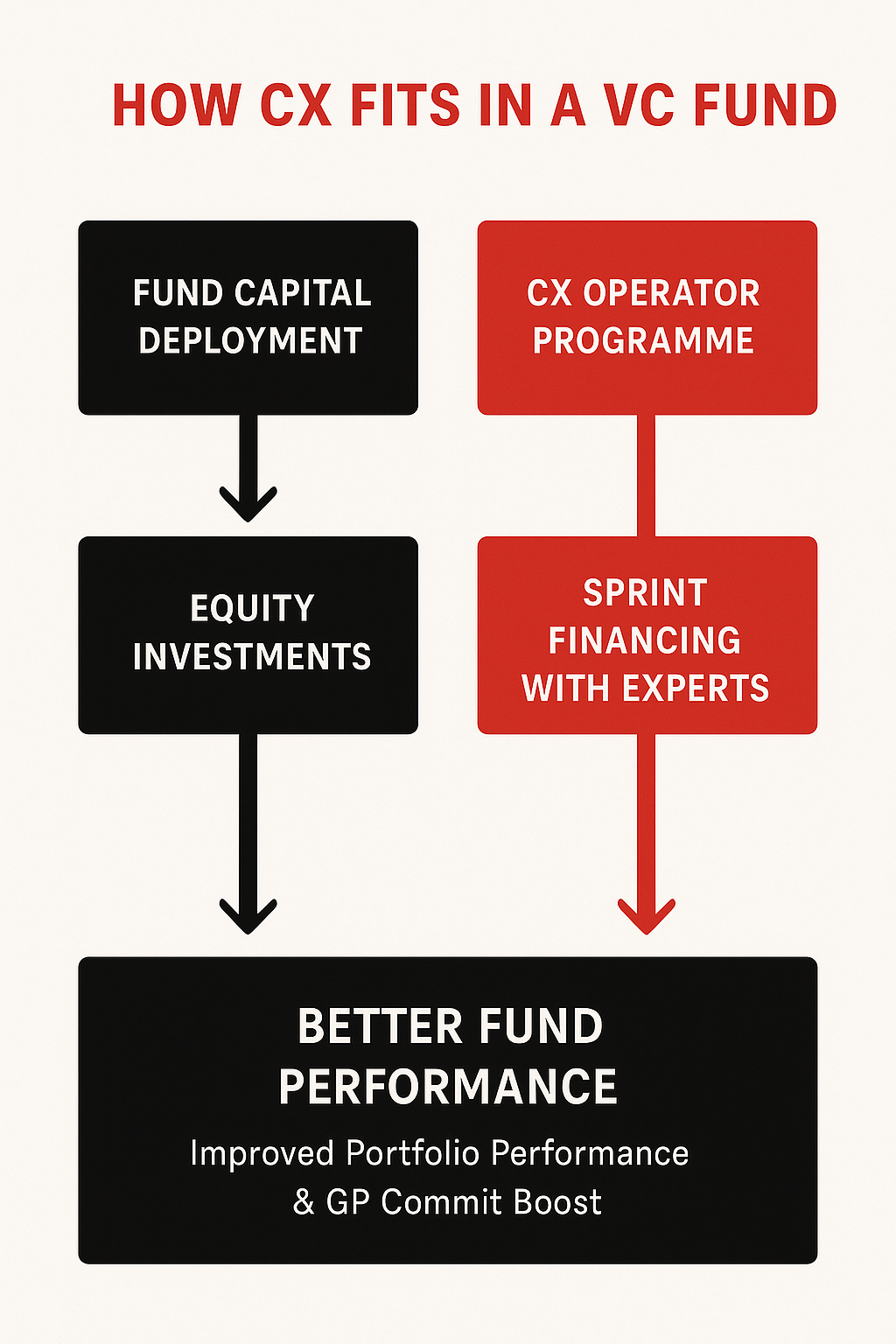

Smart studio managers are realizing that by the time they launch their first VC fund, innovative competitors using CX Protocol have already:

- Deployed capital into 20+ startups

- Built reputation and deal flow in their target markets

- Generated significant platform revenue

- Attracted the best experts with meaningful upside

- Proved their investment thesis with real results

The Network Effect Advantage

Every expert you onboard becomes a business development engine. Every startup becomes a referral source. Every successful exit attracts more quality deals.

Traditional VC funds can't replicate this flywheel because they're not built for it.

The Global Arbitrage Opportunity

While competitors struggle with local fund regulations, you can:

- Source deals from emerging markets with lower valuations

- Deploy world-class experts regardless of geography

- Capture arbitrage opportunities across time zones and markets

- Build truly global portfolio companies from day one

The Strategic Imperative: Act Now or Fall Behind Forever

The venture studio landscape is consolidating around platforms that can move fast and deliver results.

Studios stuck in traditional VC fund setups are becoming irrelevant.

Here's what happens if you stick with the old model:

Year 1-2: You're setting up fund structures while CX Protocol studios are investing Year 3: Your fund finally launches—but CX studios already have proven track records

Year 4-5: You're managing one fund—CX studios are on their second generation of investments with compounding network effects Year 6+: You're fundraising again—CX studios have built sustainable, profitable investment engines

The gap becomes impossible to close.

The CX Protocol Competitive Advantage Stack

Speed Advantage

- Launch 40x faster than traditional funds

- Make investment decisions in days, not months

- Pivot strategies based on real-time market feedback

Cost Advantage

- 90% lower setup and operating costs

- No fund management salaries or compliance overhead

- Revenue generation from multiple streams

Structural Advantage

- Expert networks create sustainable competitive moats

- Hybrid deal structures optimize for all market conditions

- Global reach without regulatory friction

Technology Advantage

- Built-in analytics and performance tracking

- Automated matching and due diligence workflows

- Smart contracts reduce legal overhead by 80%

Network Advantage

- Every participant becomes a growth engine

- Cross-portfolio collaboration and deal sharing

- Reputation systems that attract top-tier opportunities

The Decision That Defines Your Studio's Future

You have two choices:

Choice 1: Spend the next 18+ months and £500k+ building yesterday's investment vehicle while your market moves on without you.

Choice 2: Launch a next-generation investment platform in 6 weeks, start generating revenue immediately, and build the kind of expert network and portfolio flywheel that creates lasting competitive advantage.

The CX Protocol isn't just an alternative to VC funds—it's the evolution beyond them.

Ready to Stop Wasting Time and Start Winning?

The studios that move first will build insurmountable advantages.

The studios that wait will become footnotes in the industry's history.

The CX Protocol is your fast-track to becoming the dominant player in your market, while competitors are still figuring out their fund paperwork.

P.S. Every day you delay is another day your competitors get ahead. The early-mover advantage in venture studios is exponential, not linear. Don't let bureaucracy cost you your market position.