How incubators and accelerators can grow sustainably with CX

Introduction: A model under pressure

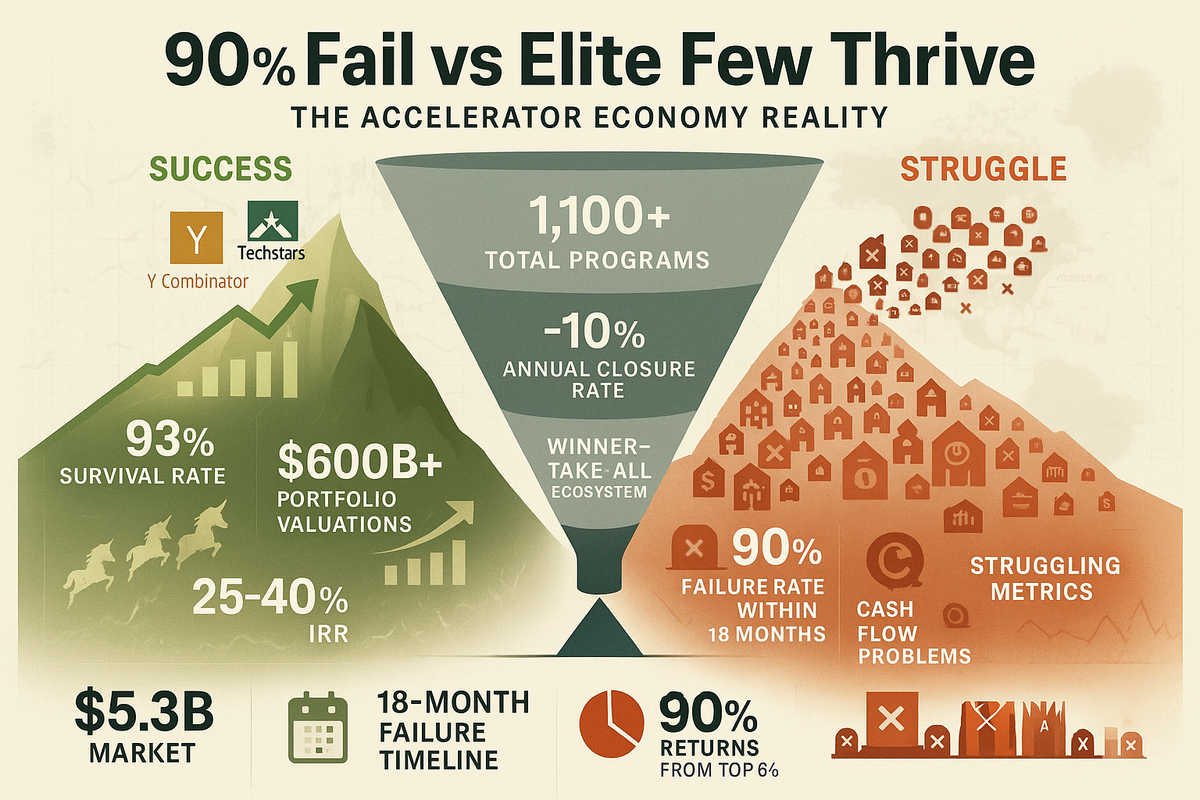

For two decades, incubators and accelerators have been the front door to innovation. They run cohorts, host demo days, and trade equity for access to mentorship, space, and networks. But the cracks are showing.

Funding is harder to secure. Alumni often disengage once they graduate. The equity they take rarely converts into meaningful returns. And at the core, founders increasingly need execution, not just advice.

That tension leaves operators in a difficult spot: how do you stay relevant and financially sustainable without reinventing your entire model?

The execution gap in incubators & accelerators

The challenge isn’t effort—it’s economics.

- Cohort churn: Programmes build energy during the 3–6 month cycle, but struggle to create lasting portfolio value.

- Equity-for-programme: Asking for 5–10% equity feels costly to founders, yet delivers little liquidity to operators.

- Grant dependence: Many accelerators survive on sponsorships or public money, which can vanish overnight.

The result: incubators and accelerators are trapped between being too fragile to scale and too undercapitalised to compete.

What are their options?

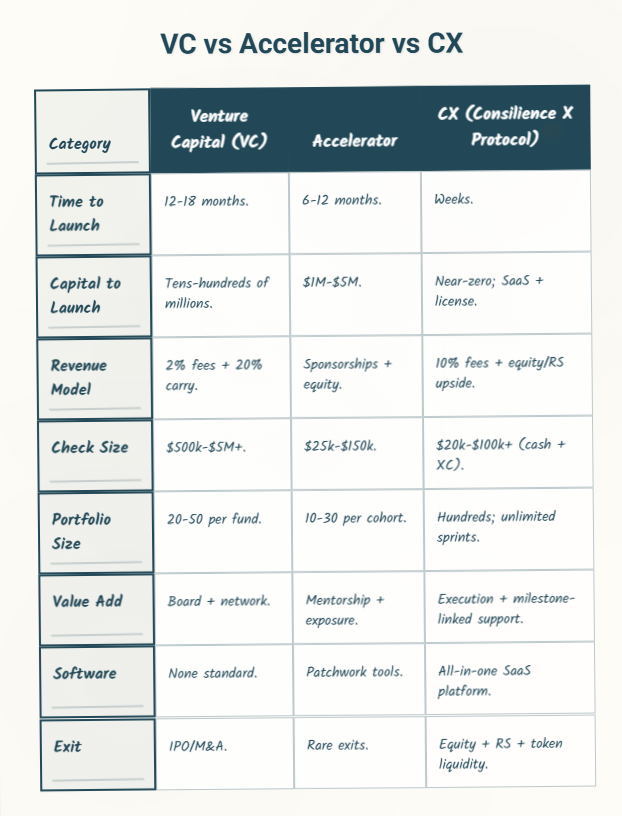

Incubators and accelerators today sit at a crossroads. To stay relevant and sustainable, they have three strategic paths:

1. Stay traditional

Run cohorts, stage demo days, and take equity in exchange for programme access.

- Upside: Simple, recognisable model. Easy to explain to founders and sponsors.

- Downside: Alumni drift after graduation. Revenue depends on grants or corporate sponsorship. Portfolio upside is highly diluted and long-tailed.

2. Become a micro VC fund

Raise a small pool of capital to back alumni and claim GP upside.

- Upside: Stronger financial alignment with founders. Ability to deploy follow-on capital.

- Downside: Expensive to launch and regulate. Fund management overhead absorbs scarce talent. Liquidity is tied up in 7–10-year cycles.

3. Layer in CX as a third model

Operate an execution-led programme under your own brand, powered by Execution Capital (XC).

- Upside:

- Launch in weeks, not years—no fundraise required.

- Founders hire vetted experts with a capped, milestone-based Build Budget.

- Operators earn orchestration fees on every sprint plus long-term upside from XC.

- Alumni stay engaged through expert networks and proof-of-execution.

- Downside: Requires discipline on governance (milestones, Flowback Loop) and a commitment to “execution first, capital second.”

How CX works inside an accelerator

Execution Capital (XC) is not equity, not debt—it’s a Build Budget. Startups spend XC on vetted experts today; they only repay later if milestones are hit, and repayments are capped (the FlowCap).

The model follows a simple loop:

- Ticket → Startups post precise requests for expert work.

- Sprint → Experts bid and deliver scoped milestones, paid in cash + XC.

- Flowback Loop → If milestones succeed, startups repay. 90% of repayments buy back and burn XC from experts, while the Operator earns a 10% orchestration fee.

This creates a circular economy where founders don’t bleed runway, experts build a portfolio, and incubators gain sustainable revenues.

Benefits for incubators and accelerators

- Speed: Programmes launch in weeks, not months. No regulatory burden, no GP/LP structure.

- Power: Build bigger portfolios by mobilising experts at scale.

- Sustainability: Earn recurring orchestration fees on every transaction plus long-term upside from retained XC or equity.

- Founder-friendly: Alumni keep more ownership and repay only on success.

- Engagement: Expert networks and alumni stay active through ticketflow and milestone delivery.

- Proof of execution: Operators can show data on how quickly ventures hit milestones, rather than relying on vanity metrics.

A practical example

Before: An accelerator takes 8% equity in a startup for a 3-month programme. The founders get office hours, mentorship, and demo day exposure. Alumni engagement drops once the programme ends. The operator waits years—often in vain—for liquidity.

After CX: The same accelerator gives each startup a £50k Build Budget in XC. Startups use it to hire vetted experts for product launches, growth campaigns, or data infrastructure. Founders repay only after hitting revenue milestones, capped at 3×. The accelerator earns orchestration fees on every sprint and retains upside from XC, while founders keep more equity.

Metrics that matter

Operators using CX can track execution in real time:

- Ticket velocity: How fast startups post and fill tickets.

- Bid density: How many experts compete per request.

- Milestone hit rate: The percentage of sprints delivered successfully.

- Flowback coverage: Ratio of repayments to Build Budgets issued.

- Operator revenue: Orchestration fees plus XC upside.

These metrics create a transparent scoreboard—useful for sponsors, corporates, or LPs evaluating performance.

Implementation roadmap

- Week 1–2: Deploy CX platform under your brand.

- Week 3–4: Onboard your alumni and expert network.

- Week 5+: Begin ticketflow and milestone sprints.

- Month 3–6: Prove Flowback Loop and start generating operator revenue.

It’s a set-and-forget system once parameters are in place: cash/XC splits, repayment caps, milestone gates. The platform automates matching, contracting, payments, and reporting.

Guardrails and limits

CX isn’t a fit for every programme. If your accelerator is purely grant-funded or focused on pre-idea concepts, execution-led models may be premature. And discipline matters: milestones must be specific, repayment caps enforced, and expert quality governed.

But for incubators and accelerators serious about scale, CX closes the execution gap without the burden of raising or managing a fund.

Conclusion: A third way forward

Incubators and accelerators no longer need to choose between fragile grant models and complex micro-funds. With CX, they can run execution-led programmes that are fast to launch, founder-friendly, and financially sustainable.

Founders get what they need—expert execution tied to outcomes. Experts get upside beyond their day rate. And operators finally get a repeatable revenue model that compounds.

👉 If you run an incubator or accelerator and want to turn your alumni and network into a sustainable execution engine, explore how to run your programme on CX.