From Deal Training to Deal Engine: How CX Turns Harbour Club Alumni into Sector PE Operators

I joined The Harbour Club on 25 April 2024 for Jeremy Harbour's method: buy businesses for little or no money down, create value, exit at multiples. I bought the WIBO course but immediately hit a technical snag—I wasn't receiving the course emails despite my purchase being confirmed.

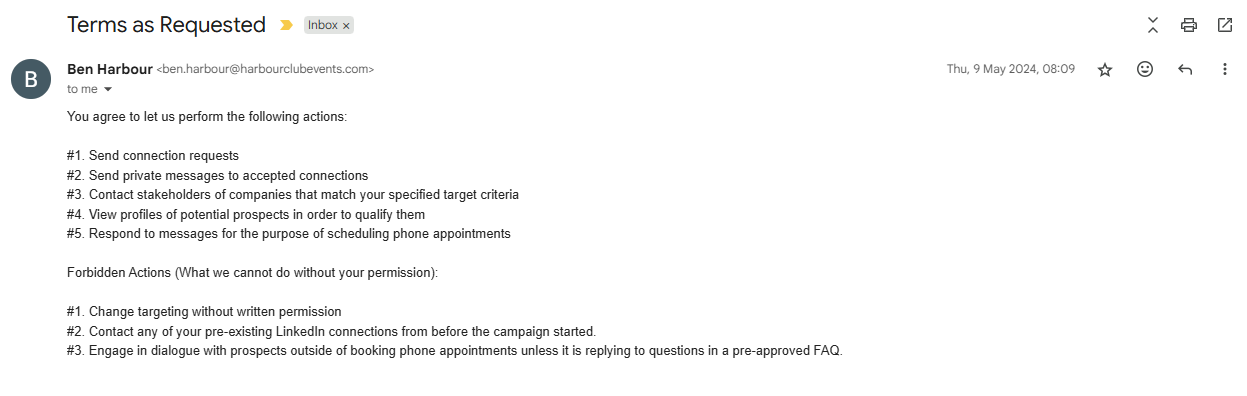

After sorting the access issue, I dove into the training. I sourced retiring owners, negotiated creative terms, explored agglomerations. The methods were solid, but I quickly realised I wasn't naturally gifted at lead generation. So I did what any sensible person does when they recognise a weakness—I hired Ben Harbour to handle my lead generation campaigns.

The irony wasn't lost on me: I was learning to buy businesses whilst simultaneously outsourcing a core function of my own business development. But it worked. Ben's team generated qualified leads, and I was invited into the WIBO Community WhatsApp group, connecting with other alumni navigating similar challenges.

Here's what I discovered through this process: knowing how to buy a business isn't the same as transforming it. And more importantly, recognising when to bring in experts—rather than struggling alone—became the foundation of everything that followed.

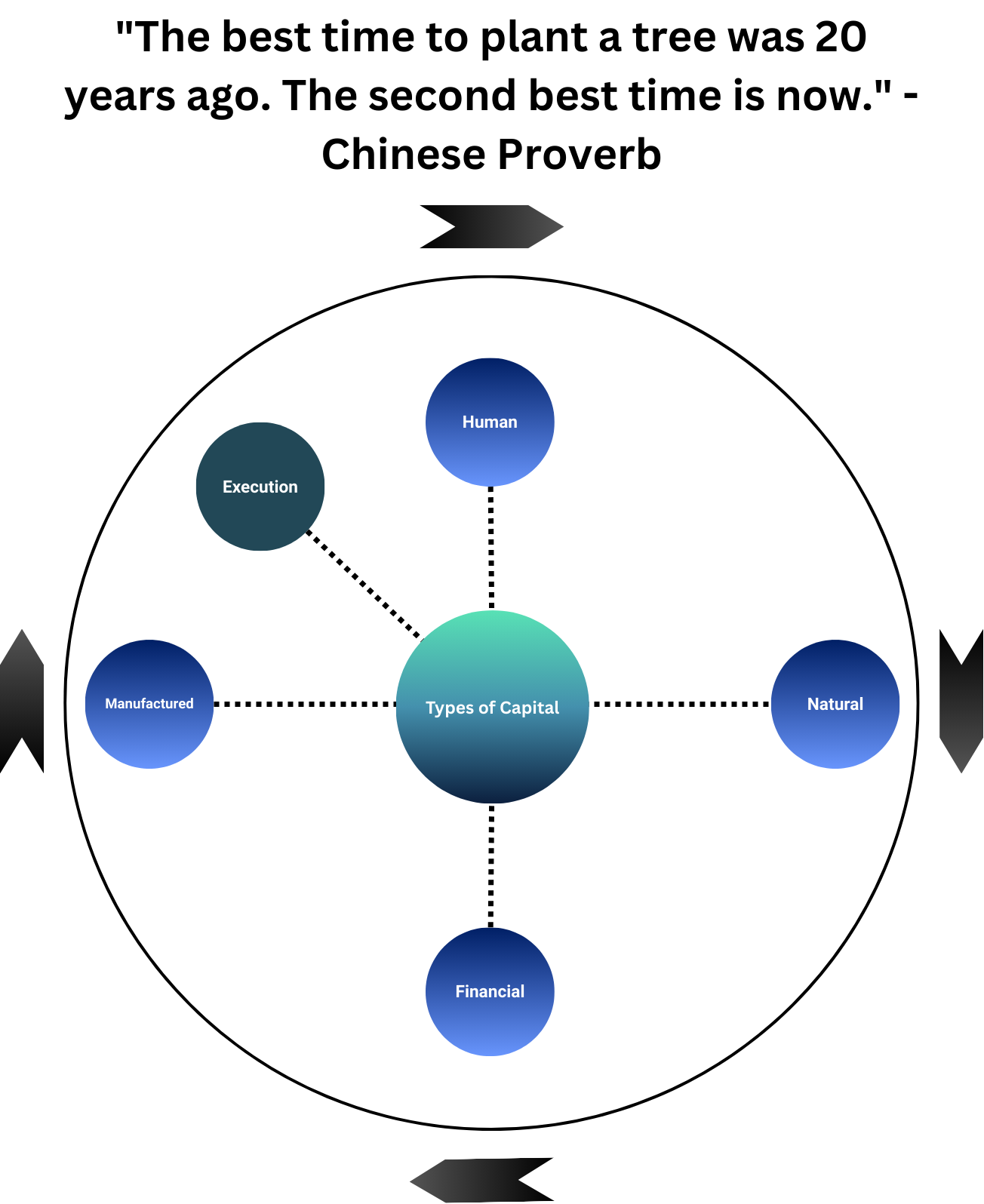

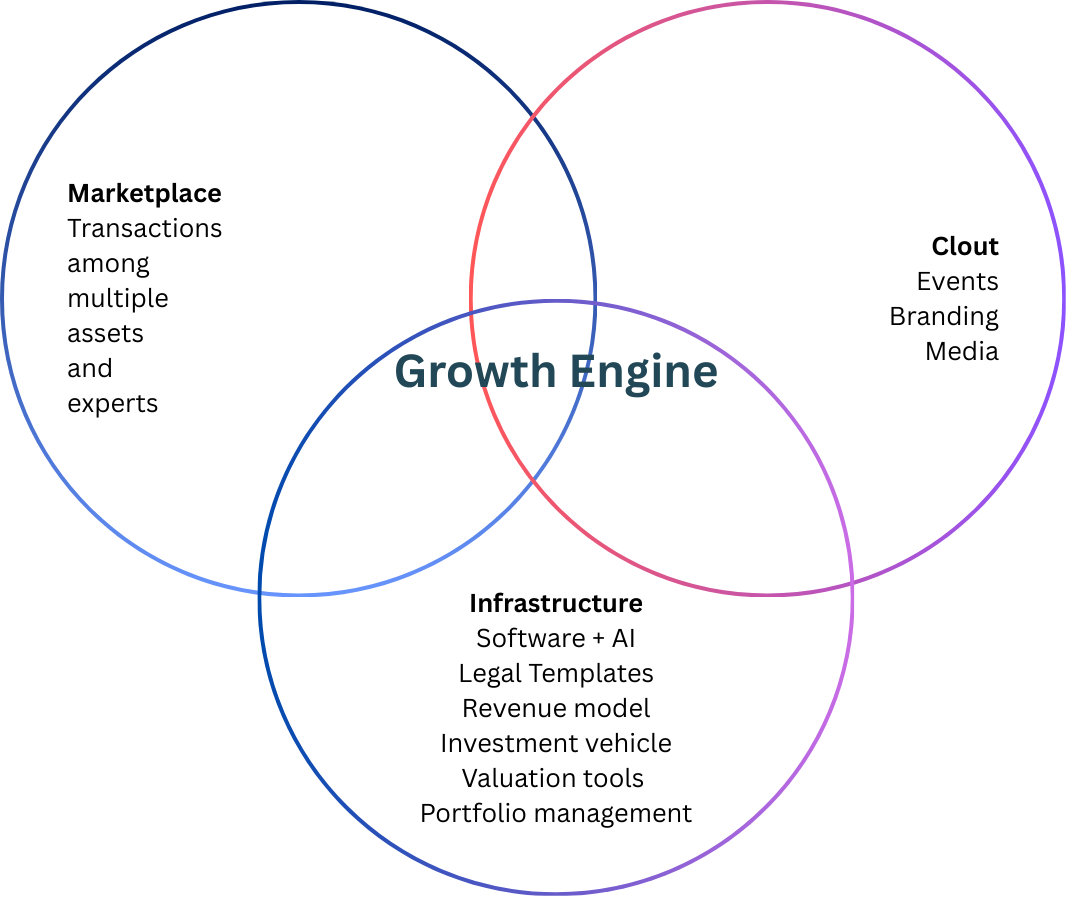

Through building Consilience Ventures and selling TokenSphere to Avrio—where we pioneered tokenised real-world assets—I discovered my actual strength wasn't dealmaking. It was connecting assets, experts, and operators to create measurable growth.

That realisation became Consilience X (CX): turnkey infrastructure for ecosystem builders to run expert-led value-creation programmes. For Harbour Club alumni, it means turning training into a scalable execution engine.

The Problem Nobody Mentions

You've done the course. You know deals exist. You've maybe sourced a few. But here's what happens to most Harbour Club graduates: deals don't close, or when they do, the business stalls.

Common roadblocks:

- No dedicated team to execute value-creation plans

- Limited capital for post-acquisition improvements

- No systems to integrate multiple acquisitions

- No repeatable model for scaling beyond one deal

Result: 700 letters sent, 3 meetings booked, 0 deals closed—or one deal that becomes a full-time job instead of a portfolio.

The Vision: From Graduate to Sector PE Operator

Imagine leaving Harbour Club with more than knowledge. Imagine deploying your own fully staffed, sector-specific execution engine—a CX Protocol instance that provides:

- Pre-vetted fractional experts (CFOs, marketers, operations specialists)

- Sprint financing for growth projects without personal cash requirements

- Central dashboard to manage every portfolio company

- Standardised integration playbooks

You're no longer just a dealmaker. You're an operator who transforms acquisitions quickly and at scale.

Concrete Scenarios: CX in Action

HVAC Roll-Up

CX Protocol Deal Terms Structure

1Expert Deployment Terms

Squad Composition

Payment Structure to Experts

2Execution Capital (XC) Mechanics

Repayment Trigger

Grace Period: 3 months from milestone completion before repayments can begin

Repayment Mechanics

XC repayment: £20K × 8% = £1,600/month

Time to cap: £250K ÷ £1,600 = 156 months (if sustained)

Revenue Attribution

3Milestone Structure & Acceptance Criteria

CFO Milestones:

- Cash flow forecasting system implemented

- Monthly P&L automation with variance analysis

- KPI dashboard (13-week cash flow, gross margin by service line)

Marketing Milestones:

- Lead generation system (Google Ads + local SEO)

- CRM integration with pipeline tracking

- Customer retention programme launched

Operations Milestones:

- Service contract standardisation (3 tiers)

- Technician scheduling optimisation

- Parts inventory management system

Integration Readiness:

- Standardised processes documented

- Management team trained and autonomous

- Financial controls audit-ready

- Customer contracts transferable

4Operator Governance & Quality Assurance

HC HVAC Southeast USA Operator Responsibilities

Reporting Cadence

5Financial Projections & Economics

Investment Economics

Revenue Impact Projections

18-Month Target: £3.6M annually (50% increase)

Incremental Revenue: £1.2M annually

Monthly Incremental: £100K

XC Repayment Rate: 8% of £100K = £8K/month

Time to Cap: 39 months (£315K ÷ £8K/month)

Exit Economics

6Risk Scenarios & Mitigation

Underperformance Scenarios

Overperformance Scenarios

Why This Is 10× for Harbour Club Alumni

| Without CX | With CX |

|---|---|

| Knowledge without execution support | Knowledge + instant operational capacity |

| One-off dealmaking | Repeatable acquisition & integration machine |

| High cash demands for growth | Cash-light sprint financing with milestone repayments |

| Slow scaling | Faster integration → faster exits → higher IRR |

Personal portfolio growth: 1 company in 3 years versus 5 companies in 3 years with CX.

The Multi-Operator Vision

With CX, alumni can run protocols by sector, region, or investment thesis:

- HC Midlands Manufacturing CX — Light manufacturing roll-up

- HC Florida B2B Services CX — Family-owned succession plays

- HC APAC IT Services CX — Managed services roll-up to IPO

- HC California Food CX — Speciality food consolidation

All benefit from shared expert pools, standardised legal frameworks, and Harbour Club brand credibility.

How CX Works: The Mechanism

CX equips ecosystem builders with complete infrastructure: investment vehicles, token issuance (Execution Capital), governance frameworks, operator software, revenue models, and legal playbooks.

For participating companies: Deploy senior experts using cash plus Execution Capital (XC). Work is scoped by milestones. Repayments begin when revenue starts and end at a fixed cap, aligning incentives whilst protecting cash.

Payment split: Default 30% cash, 70% XC to experts. Companies repay XC only from revenue, up to a predetermined cap (typically 2-3× the XC value).

Governance: Local operators manage quality, milestones, and acceptance criteria. No black boxes.

The Call to Action

You already know how to buy businesses. Now own the process of transforming them—without hiring massive teams or risking personal capital.

CX Protocol provides instant operational capacity, funding for growth without personal debt, and a repeatable model for building sector-specific empires.

It's not just training anymore. It's your launchpad to becoming a micro-private equity powerhouse.

Ready to turn deal knowledge into deal execution? Book an Operator consult to explore launching your sector-specific CX Protocol.

Consilience X is the turnkey infrastructure for ecosystem builders—investment vehicles, token issuance, governance, software, business model, and legal playbooks—to launch expert-led value-creation programmes under their own brand. Harbour Club alumni use CX to scale from dealmakers to operators.