Do This If You Want to 10x Your Event Business Revenue

Your startup events generate millions in founder connections, expert relationships, and deal flow. Then everyone goes home, and you wait six months for the next event to monetise those relationships again.

What if your March event could generate revenue through December?

What if your speaker network became your revenue engine?

What if positioning yourself as the growth enabler, your community already sees you as actually paid?

The Problem: You're Already the Hub, But Missing Most of the Revenue

Right now, you do this:

- Source quality founders for your events

- Curate expert speakers who deliver value

- Facilitate introductions and connections

- Watch founders struggle to execute post-event

- See experts offer help with no payment structure

- Lose momentum between events

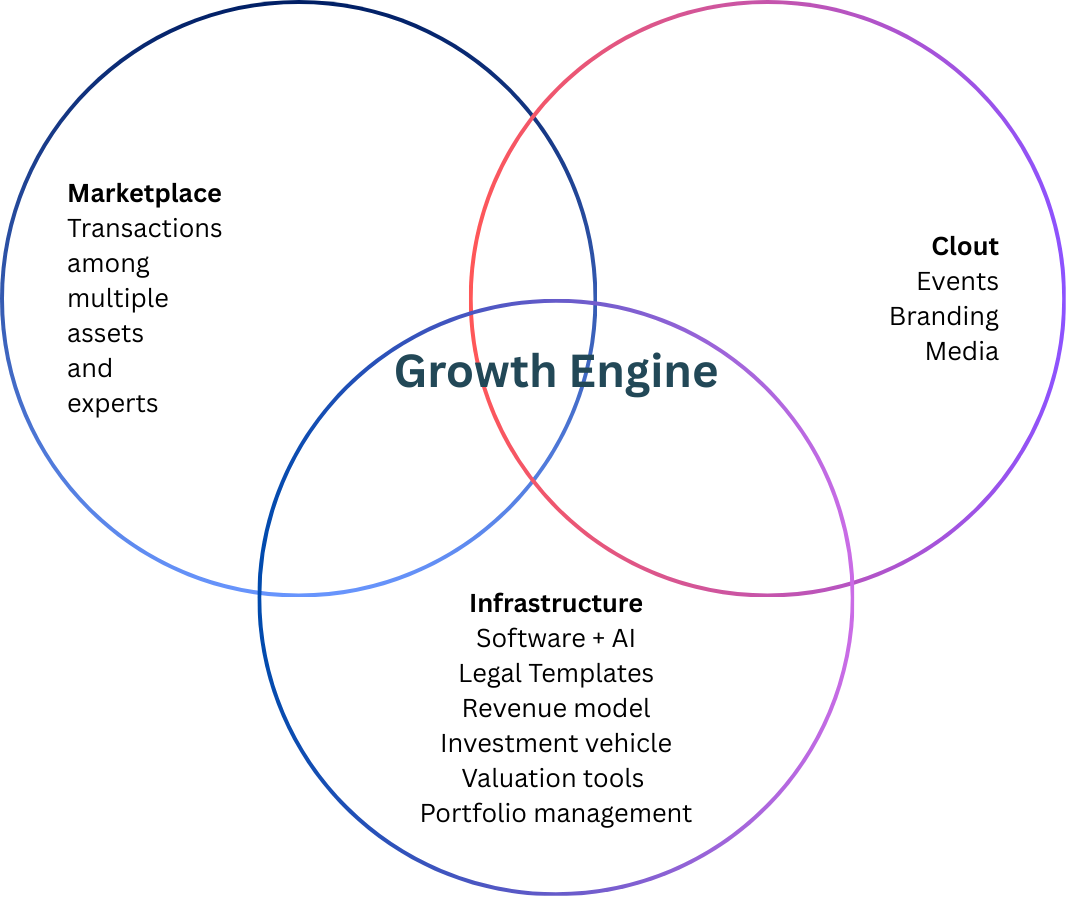

What CX Protocol Does: Launch Your Own VC and Accelerator Without the Hurdles

It's like launching your own VC and accelerator at the same time without the traditional barriers—no need to raise a fund, build technology infrastructure, hire legal teams, or create operational frameworks from scratch.

CX handles all the operational complexity while you focus on what you do best—curating quality networks.

CX Automates:

- Payment processing (cash + Execution Capital (XC) splits)

- Milestone tracking and acceptance criteria

- Expert-founder matching based on your selections

- Revenue-linked repayment calculations and collections

- Legal frameworks and compliance

- Quality assurance workflows

- Performance reporting and analytics

You Focus On:

- Selecting which founders from your events join programmes

- Choosing which experts from your network participate

- Setting quality standards for your brand

- Building your reputation as the premier growth enabler

The Real Problems You'll Solve (And Why Everyone Wins)

Understanding the core pain points you're addressing helps explain why this creates a self-reinforcing flywheel that grows stronger over time.

For Founders/Companies: The Execution Gap

Current Problem: Founders leave your events energised but can't afford senior talent. A startup with £8k MRR can't hire a £120k CTO or £80k Head of Growth. They bootstrap with junior talent or try to DIY, leading to slower growth and higher failure rates.

Your Solution: Senior experts work for 30% cash + 70% XC. That £120k CTO now costs £36k cash upfront. Founders preserve runway while accessing top-tier execution. When revenue grows, XC repayments begin—but they're capped, so there's no unlimited downside.

For Experts/Consultants: The Revenue Ceiling Problem

Current Problem: Senior consultants face a brutal choice—charge day rates with no upside, or take equity with no immediate income. A growth expert charging £1,500/day maxes out at £300k annually if fully booked. Meanwhile, the startups they help 10x in value, but experts capture none of that upside.

Your Solution: Experts earn immediate cash (£36k from that CTO example) plus capped upside via XC. When their startup goes from £8k to £50k MRR, XC repayments flow based on that growth. Top experts can now earn £200k+ annually from base fees while building a portfolio of capped revenue shares.

For Investors: The De-risking Problem

Current Problem: Investors see hundreds of pitches but struggle to identify which founders can actually execute. Post-investment, portfolio companies often struggle with hiring and execution, leading to slower growth and higher failure rates.

Your Solution: Companies in your programme have proven execution track records with senior expert teams already in place. Investors can see milestone delivery, revenue growth, and operational metrics before investing. Plus, the XC model means companies preserve cash runway longer, reducing burn rates.