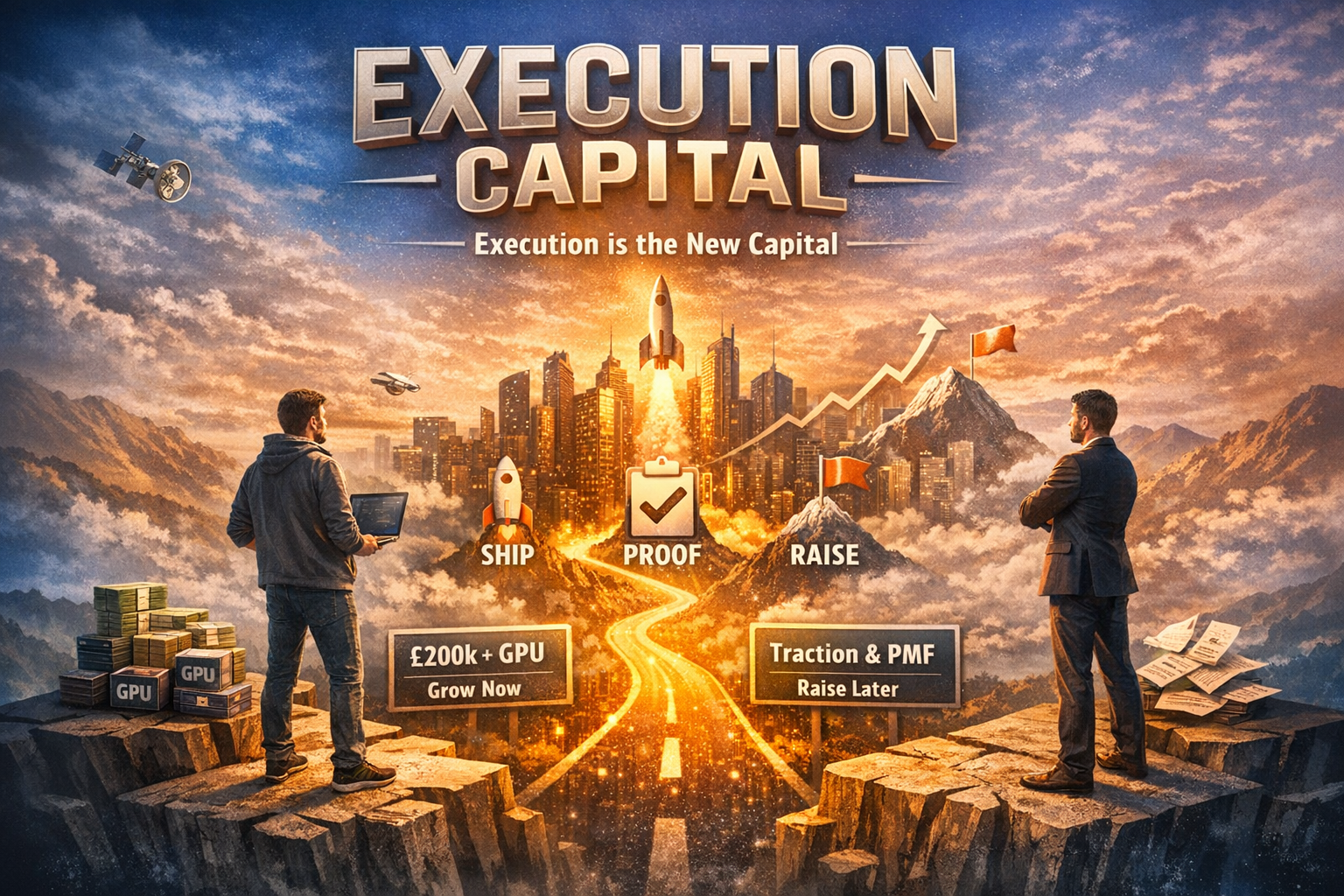

Paying with equity is expensive" is a myth. Here's the proof.

"Equity is expensive" is repeated like a law of physics. It's mathematically wrong. The cost was never the equity — it's always been the mess. Here's the proof, and what smart investors are doing about it.